Photo/ Supplied

Cost of living crisis is not over yet

Pacific communities continue to battle economic crises with debt, housing, and food costs among the unwanted headaches.

How the Pacific region could benefit from Argentina’s economic rebound, expert

Dave Rennie becomes first All Blacks coach of Pacific heritage

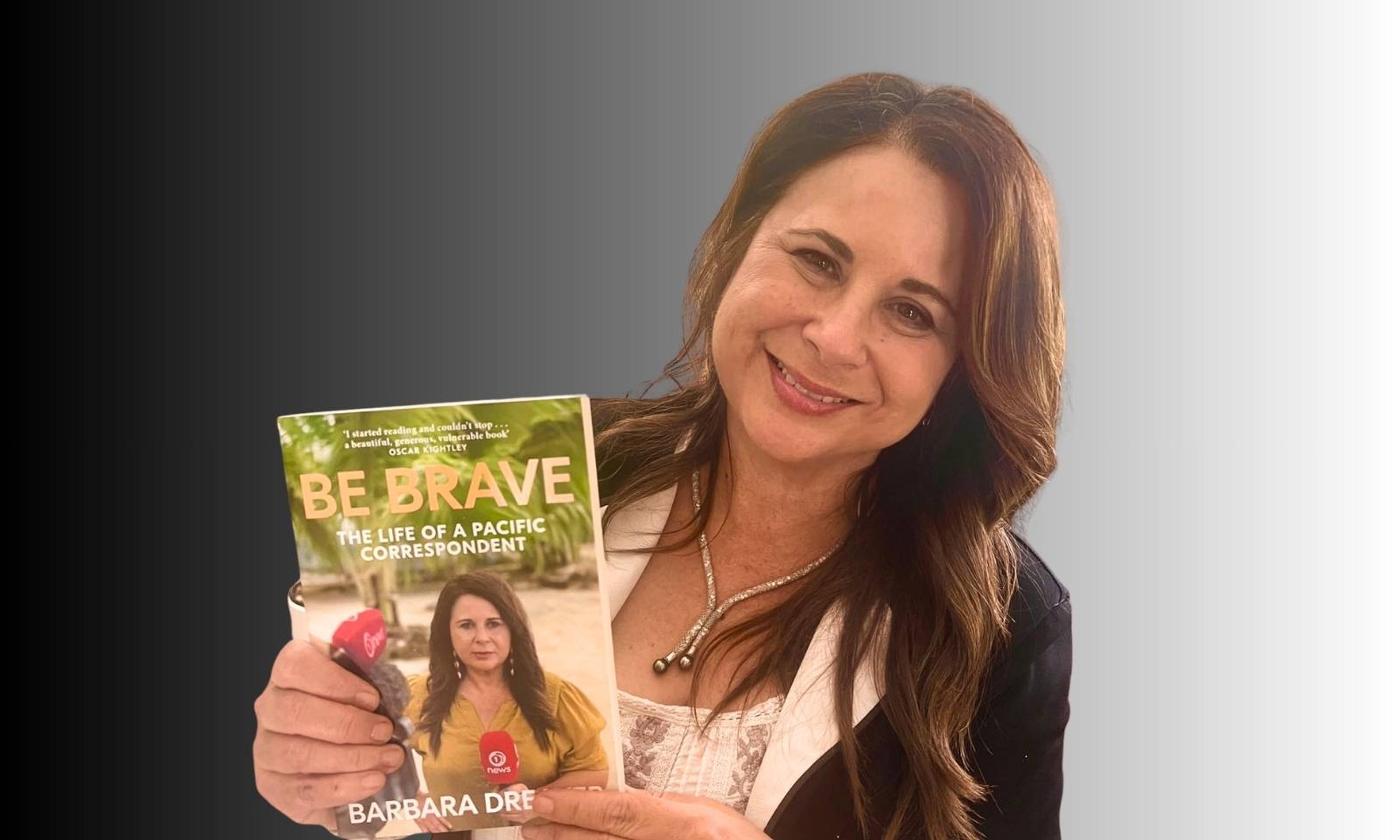

‘Without fear or favour’: Barbara Dreaver chronicles 30 years on the Pacific frontline

Tongan family in Abu Dhabi recount explosions as Middle East conflict escalates

How the Pacific region could benefit from Argentina’s economic rebound, expert

Dave Rennie becomes first All Blacks coach of Pacific heritage

‘Without fear or favour’: Barbara Dreaver chronicles 30 years on the Pacific frontline

Pacific communities continue to battle economic crises with debt, housing, and food costs among the unwanted headaches.

Kiwis have been battling the cost of living crisis since 2021, and Pacific communities are among the hardest hit, a Pacific provider has warned.

Tangata Atumotu Trust in Canterbury says an unwanted headache for Pasifika is “trying to manage their debt”.

Trustee Losana Korovulavula said other challenges included rent, housing, and food costs.

“There are many debts that they are struggling with. It's a tough time. It’s sad to see people in that situation,” she told 531pi’s Pacific Mornings show on Wednesday.

More than 70 per cent of Pacific households are renters.

“A major part of people’s wages or salaries goes toward housing.

“It's also the condition of the houses that they are renting in. We tend to look for big houses, whether it's moldy or whether it's cold, as long as it's a big house, and you know Pacific families are big.”

UN issues grim warning

In January, the United Nations said inflation in Aotearoa would fall “fairly gradually” over the next 12 months.

In its 2024 World Economic Situation and Prospects report, the UN projected that “New Zealand's inflation will remain relatively high in 2024 due to an acceleration in rental prices driven by housing supply shortages.

“New Zealand's consumer price index is projected to fall to 3.4 percent in 2024 before dropping to 2.6 percent in 2025.”

Since 2021, inflation has remained “stubbornly high” at 5.6% - more than double the Reserve Bank's (RBNZ) target, the report said.

Korovulavula said the economic situation is worrying, with the latest Statistics NZ data showing food prices remained 6% higher in November than they were 12 months earlier.

Stats NZ said the gross domestic product had fallen point one percent between October and December, following a 0.3 percent contraction in the previous quarter.

It meant the country was back in a technical recession for a second time after a brief period of recovery last year.

Minister for Pacific Peoples Dr Shane Reti said on Tuesday he hopes the upcoming tax cuts will ease the blow that the economic downturn may have on families.

"People will know about the cost of living, when they pay for their electricity, or they buy their fuel, they'll feel it,” he told Pacific Mornings.

“But there was one good piece of news last week that the price of fruit and vegetables dropped by 9.3 per cent. That's certainly a good thing - and we need to see if we can keep that trend going.

“Our key focus is the cost of living and how we can have people have more discretionary spending in their pockets - and so we've talked a lot about tax cuts and how we can put more money into people's pockets.”

Korovulavula said food was a big issue because “people are finding it hard to even buy the good stuff, the good things that the family can survive on.

“Fruit and vegetables are not cheap. It may be cheaper for higher incomes, but not for most of our families, not for most of our working people.

“To stay well and healthy, people need to buy just the important things that they need.”

Seeking loans to survive

She said Pacific people are also seeking support from Work and Income or loan sharks “to be able to survive daily”.

“When people are struggling, they will look for ways in which they can get some source of money. If they can’t get the money from a bank loan, they go to loan sharks because they are easier to access. Then there’s the after-pay.”

Korovulavula said one way that Pasifika could avoid a financial crisis was to prioritise, “budget well and have savings”.

“When you get your pay, start to put things aside, like having a discretionary or emergency fund so that you can go there whenever there are rainy days and not really dip into your money, because you need to budget properly.

“With our way of life, we are a very accommodating community, and we don't say no, we need to start learning to say no. We need to prioritise so that when we need the finances, it’s there whether it’s for a funeral, school, or the community.

“We cannot keep depending on others to help us all the time. Many of us have moved here from the islands and we need to start learning how to budget our money and also how to save, so that when we have an emergency, whether it's health, death, or celebrations, we don’t need to ask anyone.”

The Government’s Budget will be released in May.

Watch full interview on 531pi: