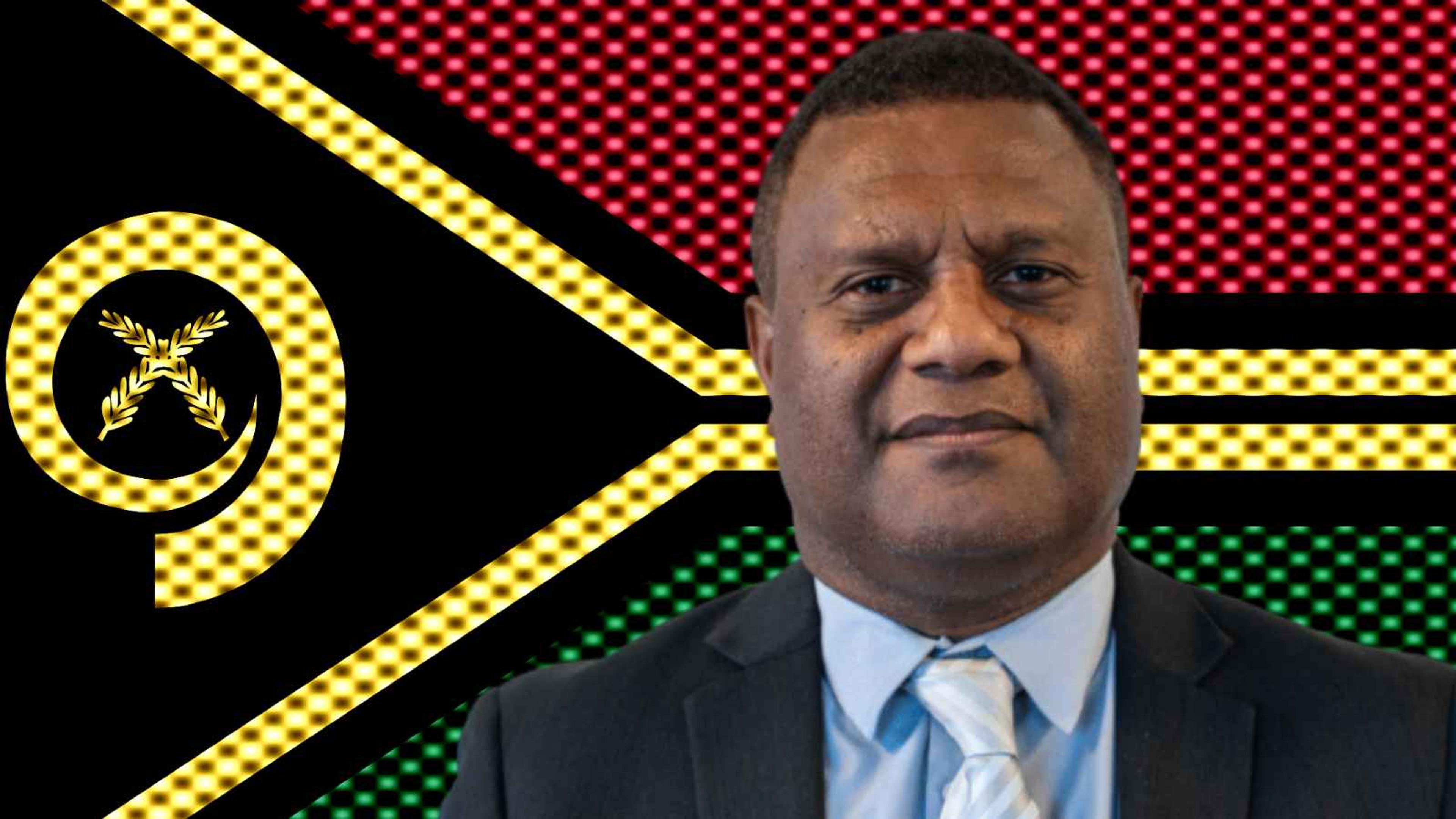

Despite division over Budget 2025, Finance Minister Nicola Willis remains steadfast in the changes proposed in her second financial plan for Aoteraoa.

Photo/PMN Composite/RNZ

The hidden costs of prioritising government debt: A closer look at fiscal austerity

The Growth Budget promises to lower the national deficit, but it relies on a flawed belief that running a government is the same as managing a household budget, writes PMN News Reporter Andre Fa'aoso.

Manurewa charity requests $30,000 to keep Pacific seniors monthly gatherings

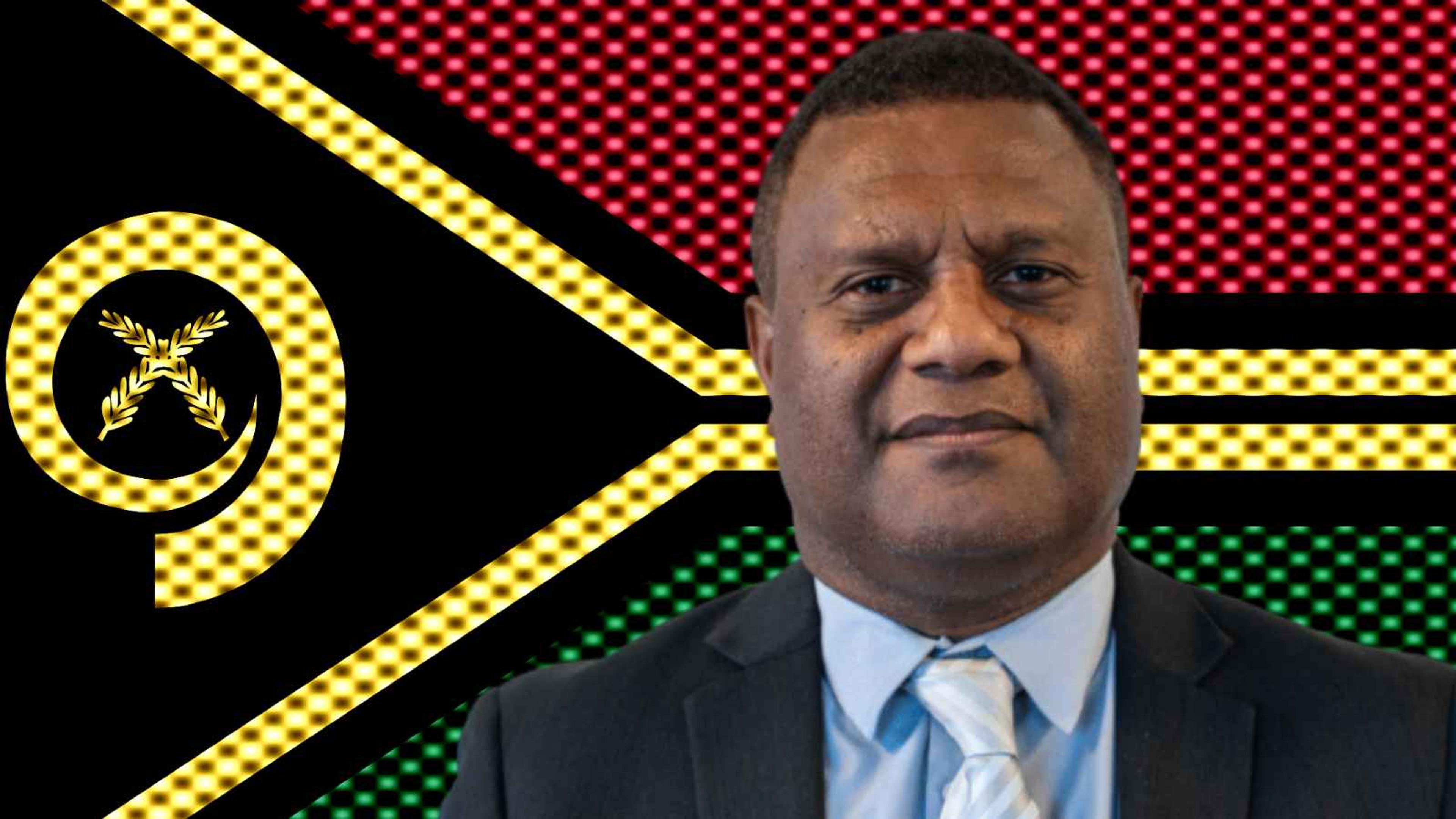

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Pageant talk: Pacific queens on colourism, transparency, and online backlash

Manurewa charity requests $30,000 to keep Pacific seniors monthly gatherings

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

There’s growing criticism around the Budget announced last week.

Many New Zealanders are concerned that the Government’s focus on cutting spending to tackle debt is based on a misleading comparison between how families and governments manage money.

While the government’s position, led by Finance Minister Nicola Willis, insists that lowering debt is a priority, not everyone agrees.

Critics have been vocal even before the Budget was released.

Prime Minister Christopher Luxon and Willis have claimed that the previous Labour government spent irresponsibly during and after the Covid-19 pandemic. However, this view simplifies the complex nature of fiscal policy.

In an interview on Pacific Mornings, Luxon suggested that managing the government’s finances is like balancing a household budget.

“We've got to be responsible with the finances. That doesn't mean that we [can’t] continue to make big investments.”

He criticised the Labour government for borrowing money irresponsibly for everyday expenses, comparing it to using a credit card for regular purchases.

While this comparison might make fiscal responsibility seem important, some commentators say it overlooks how finances work.

Watch the full post-Budget panel with Dr Filipo Katavake-McGrath, Salvation Army Policy Analyst Ana Ika and PMN Political Reporter Ala Vailala below.

Economist Dr Filipo Katavake-McGrath told Khalia Strong on Pacific Mornings that this narrative takes advantage of the public's limited understanding of financial matters.

Katavake-McGrath believes that governments have often simplified how they explain spending and debt to the public.

“I find it to be a bit disingenuous, but also it exploits the lack of financial literacy in the communities that governments have a responsibility to educate around, because governments want people to use financial tools, so I don't like comparison at all.

“They say things like, ‘we've run out of credit cards’, and that seems quite simplistic to how government debt actually can work for a nation.

“This is another example of the government [and] of politicians on both sides of the House leveraging the lack of knowledge that is among the community,” he says.

From left, Winston Peters, Chris Bishop, Nicola Willis, David Seymour, and Christopher Luxon. Photo/RNZ/Samuel Rillstone

At the heart of the government’s strategy is the belief that spending less and lowering taxes will boost economic growth. The goal is to keep government debt low and create a budget surplus.

But some commentators are worried that Willis’ Growth Budget might lead to negative outcomes, as the National Party has prioritised cutting spending over innovative economic strategies.

Fiscal conservatism, the approach taken by the National and ACT parties, often leads to low spending and cuts, but can stifle creativity in economic planning. This approach has led to mixed outcomes in the past.

One major change in the Budget aimed at saving money has affected pay equity, which has faced criticism for potentially hindering the progress towards fair pay for women, especially Māori and Pacific workers.

According to Government figures, changes in pay equity are expected to save around $12.8 billion over the next four years. But many people across Aotearoa are starting to realise the negative impact of the Growth Budget on their lives.

Watch a post-Budget panel discussion with Sarah-Jane Elika, Pakilau Manase Lua, and Ala Vailala below.

Women working in low-paid jobs will struggle as the government reverses its position on pay equity claims. Vulnerable young people will find it harder to access financial support as the eligibility for job-seeker benefits gets stricter.

Young KiwiSavers are expected to contribute more to their savings while the government cuts its contribution, a decision that could cost an 18-year-old around $66,000 by the time they retire (65).

ACT leader David Seymour's comments about dismantling the Ministry for Pacific Peoples may have sparked controversy, but his party has succeeded in slashing $60 million from MPP’s budget for the next two years.

While the idea behind cutting government spending is often to promote responsibility and strengthen finances, it can lead to significant social and economic challenges.

As New Zealand navigates the ongoing economic fallout from the pandemic, many of our society's most vulnerable people continue to face hardships.

After the National-led coalition came to power, its answer to the rising cost of living appears to have been to cut jobs and social programmes as unemployment rose, the economy struggled, and a social media ban for under-16s was imposed.

The effects of cuts will be felt most deeply through New Zealand’s middle and lower classes, all for a negligible dent in paying down the country’s debt, which, according to the Treasury, is currently at 42.7 per cent of GDP in 2025, or $185.6 billion.

So, while communities are hurt and cuts deliver lacklustre results to the National and ACT’s bottom line, it is clear that reducing government debt shouldn’t be treated as a means to an end. It distorts a government’s responsibility to the well-being of its people.

Watch Christopher Luxon's full interview about changes to pay equity settlements below.

In a recent interview, Willis was reluctant to concede that the government would unlikely reach their 2028 child poverty reduction target set by Luxon on the 2023 campaign trail.

The government has decided between the haves and have-nots, targeting breadcrumbs to those at the bottom rung, and subjugating people to a system where they cannot get their feet on the ladder to rise.

The impact of these decisions will be felt for a long time.