Locked Out is a four-part radio documentary series by PMN News and Pacific Mornings.

Photo/ PMN News

Pacific home ownership: Are 'stepping stone' solutions bold enough?

Episode three of PMN's latest podcast, Locked Out, looks at policies and solutions for helping to address declining Pacific home ownership rates in Aotearoa New Zealand.

In the 1980s, more than half of Pacific households in Aotearoa New Zealand lived in houses they owned. But by 2018, it had dropped to just 21 percent. In a four-part radio documentary series Locked Out, PMN News and Pacific Mornings examines what led to the decline and potential solutions for getting back to the home ownership rates of four decades ago.

To listen to episode three - Stepping Stone Solutions - click on the link below

One of the strategies implemented by the Ministry for Pacific Peoples to increase Pacific home ownership rates was to spend almost $16 million on a financial capability programme. By the end of March 2024, just 4 percent of the participants had bought homes.

The financial capability programme is part of the Ministry for Pacific People’s (MPP) Pacific Housing Initiative and a wider Fale mo Aiga Pacific Housing Strategy and Action Plan 2030.

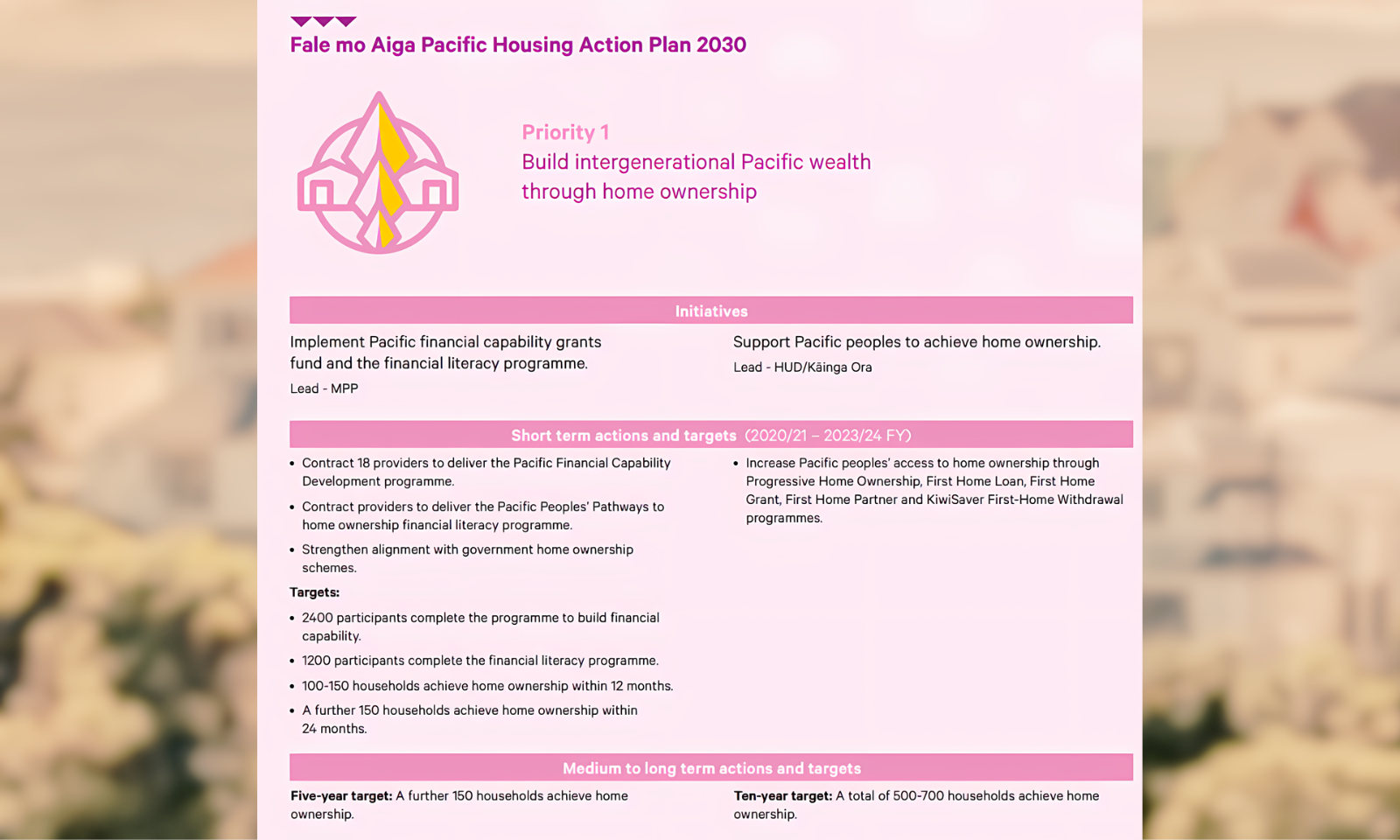

The programme initially envisaged (see photo) contracting 18 providers to deliver training for 2,400 participants, with the aim of 100–150 households achieving home ownership within 12 months and 150 more homes within 24 months.

Based on a response to an Official Information Act request by PMN News, MPP confirmed that $15.74 million had been allocated to the programme over 4 years, with 3,289 participants enrolling. By the end of March 2024, 130 participants had purchased homes and 35 had saved their home from mortgage sale – or 4 percent of the participants.

If you use June 2024 as the starting point, MPP has exceeded their enrolment and home ownership target.

Their 5-year target is that another 150 would achieve home ownership and in 10 years it would be 500-700 households.

But one estimate suggests that if Pacific home ownership rates today were as high as they were in the 1980s - when over half of Pacific households lived in their own homes – as many as 20,000 more homes need to be owned by Pacific households.

Apart from financial capability training, the MPP also ran the Pacific Community Housing Provider Registration Support Scheme, and the Pacific Building Affordable Homes initiative.

Priority 1, Fale mo Aiga Housing Action Plan 2030.

Something to build on

Salvation Army social policy analyst Ana Ika says the housing strategy is multi-faceted but perhaps not ambitious enough.

“The strategy in our view, in this current housing climate, is probably not bold enough to be able to address some of the deficits that we have in Pacific homeownership.

“It's a multi-pronged approach that they've brought about in their Fale mo Aiga strategy in addressing different areas. So not only trying to address Pacific in financial capability - because ultimately that's the crux of it, we just need the finances to be able to get into home ownership - but they're also looking at supporting sort of the ecosystem of housing.

“I think to be able to address Pacific home ownership, it needs to also include different areas, so government, communities, NGOs, charities, churches, but also the private sector.

“Ultimately, it’s (the strategy) a stepping stone that we need to be able to build on,” says Ika.

However, the Minister for Pacific Peoples, Dr Shane Reti describes the outcome of the financial capability programme, which was initiated under the Labour government, as a “success story”.

Dr Reti says it depends on whether you look at things being half full or half empty.

“Those 130 who did purchase homes and 35 who had their homes saved, that’s got a huge ripple effect. And just because people at this point in time have garnered the expertise but aren't yet ready here today to move into home ownership doesn't mean at some point in time that they won't be.

“And so we'll keep monitoring as best as we can those who have come through the course and eventually then progress into home ownership to see what sort of success rate we can have and more specifically to look at raising that rate.

“So I would put to you, any one person that is able to get into home as a consequence of this course that's a success story,” says Dr Reti.

(From left) Minister for Pacific Peoples Dr Shane Reti, Salvation Army social policy analyst Ana Ika, Founder and Director Home Ownership Pathway Andrew Lavulavu.

Investment well spent

Andrew Lavulavu, the founder of Home Ownership Pathway, who has more than 10 years financial industry experience, was one of the providers contracted to deliver the programme and agrees the programme is a success, given the dedicated one-on-one approach needed to help Pacific families with their home ownership ambitions.

“The dynamics in a Pacific family are a lot different to an average Pakeha or Kiwi family in New Zealand. So for both Pasifika and Māori you’re getting a deep understanding of their challenges and obligations and applying that into a financial and an education model which is tailored to them and supports their aspirations,” says Lavulavu.

While the cost of training averaged $4800 per participant, Lavulavu believes it’s value for money.

“Working in the industry as a financial advisor, I know exactly what my per hour rate is. The amount of time and effort and resources that we spent unpaid with Pasifika clients and families one–on-one, you'd be very surprised. Probably the bill is going to end up to be about $10,000 per client.

“So a $5,000 investment around education and financial capability is money well spent for any financial advisor out there, they would know that they'll be billing 10 to 15 grand for the amount of time that they're spending with these families,” says Lavulavu.

However, Lavulavu did have one criticism around some organisations being contracted to deliver the financial capability programme when they weren’t specialists.

“We need to get away from this mission drift, being a wraparound service provider, which is great for health, the social service sector, but it’s not for this (financial) industry which is a real niche and requires experienced qualified personnel to hit the ground running,” he says.

Complex challenges

Ana Ika, from the Salvation Army, says that there are a myriad of challenges facing Pacific in the financial space, especially the amount of the time it takes to save for a deposit.

“If we kind of zoom out from housing and look at other areas of welfare, Pacific (people) have the lowest disposable household income compared to other ethnicities,” she says.

“If we're looking at where we're employed, we're primarily employed in sort of manufacturing, social services. These are industries that get paid a lot lower than normal industries. And then at the same time, you've got the cultural component of giving,”

“It's a lot more complex than just saying our Pacific people can't afford a deposit,” Ika says.

Dr Reti says “you eat an elephant in small bites”.

“We recognise the importance of housing, so with the smallish funds that we have, we still want to make a start, although I'd put to you to have 3,289 people through the financial capability program, that's a good number.”

“We don't know at what point in their lives, maybe, they then become homeowners, but that's a small seed that has the opportunity to grow a forest,” he says.