Photo/Supplied/The Lowy Institute

Developing nations face increasing financial strain over China loans, new report reveals

The Lowy Institute warns that Beijing's role as a lender to poor and vulnerable countries has shifted dramatically from a generous capital provider to a growing debt collector.

Jai Opetaia drops German in brutal KO, keeps titles and calls for unification fights

Law expert: US boat strike controversy a lesson for the Pacific

Jai Opetaia drops German in brutal KO, keeps titles and calls for unification fights

Law expert: US boat strike controversy a lesson for the Pacific

China's role in relation to the world's developing countries, including Pacific island nations, has shifted from being a capital provider to debt collector, according to a report by the Lowy Institute, an Australian think tank.

The report states that many of these countries are struggling financially because they are repaying more in debt to China each year than they are receiving in new loans.

Several Pacific Island nations have significant debts to China, including Tonga, Sāmoa, and Vanuatu. These nations are already grappling with high levels of Chinese debt and have been seeking extensions on loan repayments.

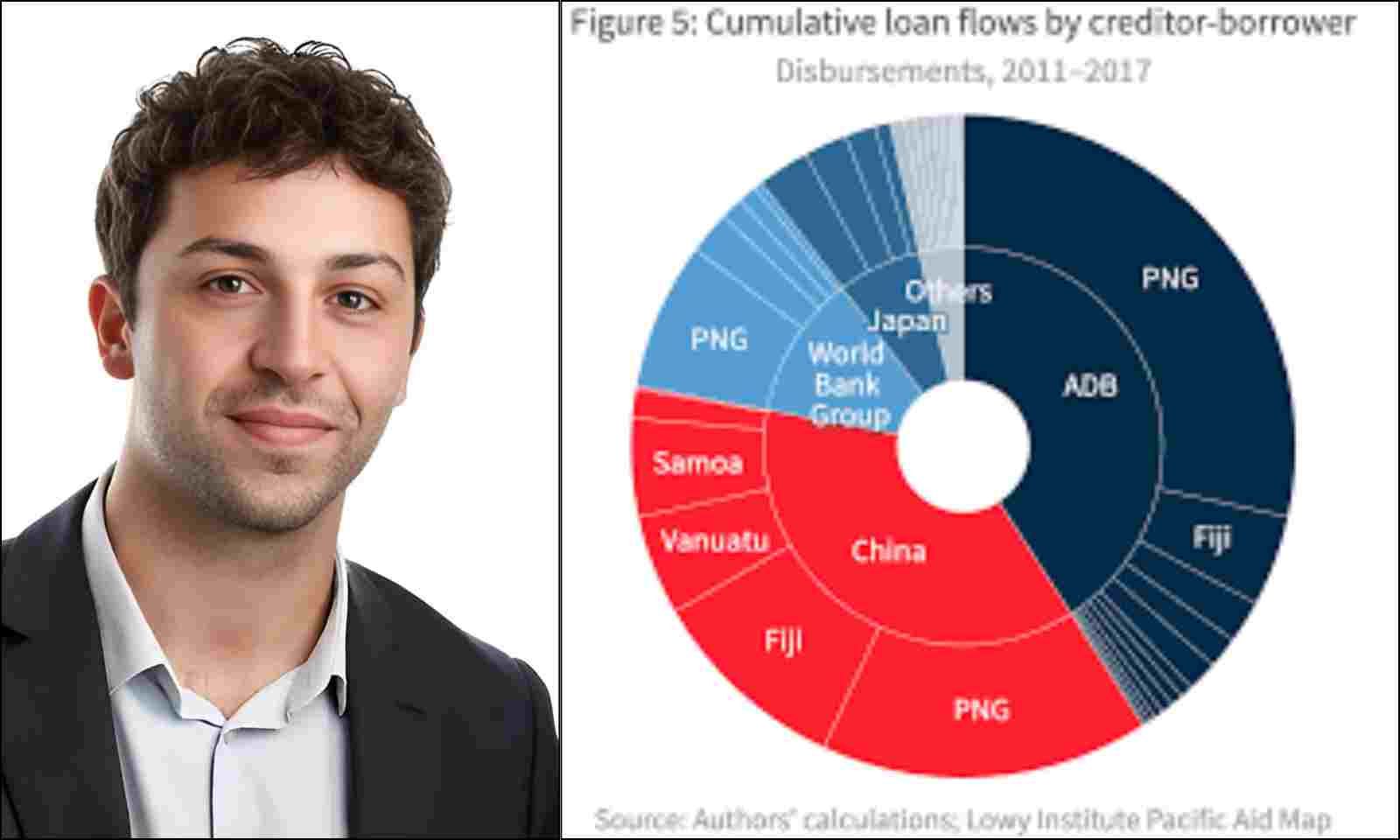

According to the AidData research lab, Fiji, Papua New Guinea, and the Cook Islands also have moderate public debt exposure to China. The Solomon Islands has also received large infrastructure loans from China in recent years.

The Lowy Institute warns that deferring these debts could lead to even greater problems for these nations.

Over the past 20 years, China has provided large loans to various countries, profoundly impacting global geopolitical and economic dynamics.

The loans mainly support infrastructure and development projects in low- and middle-income countries. The loans have also helped fuel China's fast economic expansion over the past two decades.

In 2022, China loaned NZ$194.09 billion to low- and middle-income countries (LMICs). This funding often promotes economic and infrastructure growth while simultaneously strengthening Beijing's access to resources and geopolitical influence.

This year, developing nations, including those in the Pacific, are set to repay China NZ$36.66 billion. This is largely due to repayments for project funding from China's Belt and Road Initiative, which started in the 2010s.

China has lent money to Vanuatu financing new roads for the Pacific nation's outer islands. Photo/Facebook/China Civil Engineering Construction Corporation

The Lowy Institute’s analysis indicates that these developing countries are facing overwhelming debt repayments and interest costs resulting from the surge in Chinese loans under the Belt and Road Initiative.

A data snapshot by Riley Duke, titled, Peak Repayment: China’s Global Lending, reveals that China, once the largest source of new finance for developing countries, has now become the largest recipient of debt payments from these nations, surpassing the total owed to all Western lenders.

In 54 of 120 developing countries for which data is available, debt service payments to China exceed the combined repayments owed to the Paris Club, which includes all major Western bilateral lenders.

China’s net lending position shifted rapidly in 2012. Initially, only 18 developing countries were experiencing a net drain on their finances from China, but by 2023, this number had increased to 60.

“China’s earlier lending boom, combined with the structure of its loans, made a surge in debt servicing costs inevitable,” Duke states.

“Because China’s Belt and Road lending spree peaked in the mid-2010s, those grace periods began expiring in the early 2020s - it was always likely to be a crunch period for developing country repayments to China.”

Riley Duke says that China has surpassed the total debt owed to all Western lenders. Photo/The Lowy Institute

Duke warns that the high debt burden facing developing countries will hinder poverty reduction efforts and slow overall development progress, increasing the risk of economic and political instability.

“The burden from Chinese debts coming due is also part of a broader set of severe headwinds, particularly for the poorest and most vulnerable economies,” he says.

Duke says that developing economies face additional struggles due to a more isolationist United States and a distracted Europe, which are reducing or dramatically cutting their aid support.

He adds that these countries are contending with the impacts of new trade disputes and the potential for punitive tariffs from the US.

“The Belt and Road Initiative peaked in the mid-2010s; peak repayment was reached in the mid-2020s. Now, and for the rest of this decade, China will be more of a debt collector than banker to the developing world,” Duke says.

Key findings

In 2025, the world’s poorest countries will repay record-high debts totalling NZ$23.72 billion to China.

China has transitioned from being a capital provider to a net financial drain on developing countries due to the debt servicing costs of Belt and Road Initiative projects from the 2010s, which now far exceed new loan disbursements.

Despite a decline in global lending, China continues to finance strategic and resource-critical partners.

The largest recipients of new lending include neighbouring countries such as Pakistan, Kazakhstan, and Mongolia, as well as developing countries crucial for critical minerals and battery metals, like Argentina, Brazil, Congo DR, and Indonesia.

China is facing a dilemma: it is under increasing diplomatic pressure to restructure unsustainable debts while facing domestic pressure to recover outstanding debts, especially from its quasi-commercial institutions.

Reducing Western aid and trade exacerbates difficulties for developing countries and threatens the West's geopolitical advantage.

Photo/The Lowy Institute