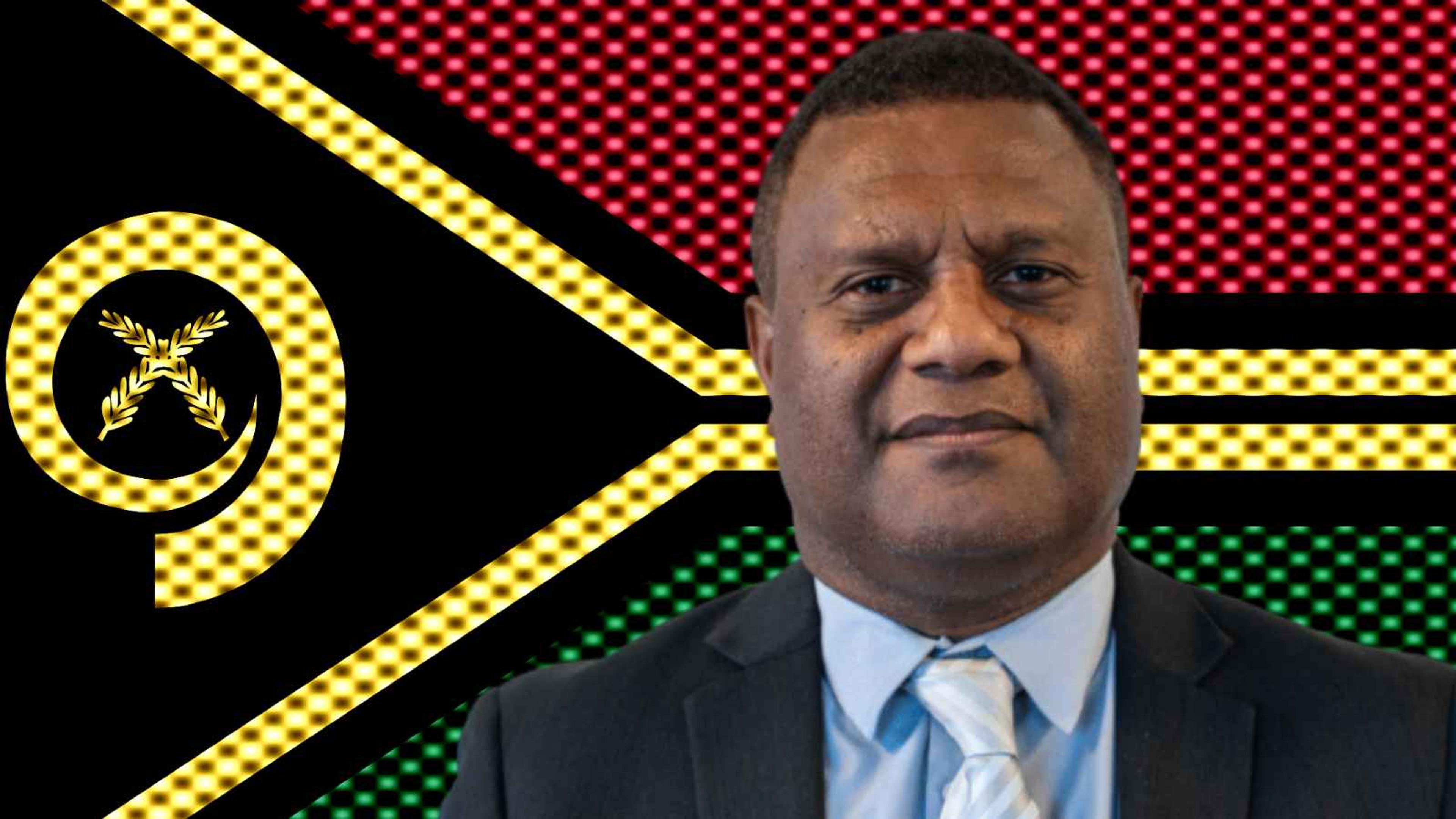

Branan Karae was re-elected as Commissioner of Vanuatu's Financial Services Commission in 2024 until 2029.

Photo/Supplied

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Vanuatu’s financial watchdog says global blacklists and shrinking banking links are making it harder to move money, grow businesses, and create jobs as the country prepares for a key review this year.

Inked across lands: How Pacific tattoo art is thriving in Germany

US funding cuts threaten to 'dry up' future of Pacific scientists - expert

Inked across lands: How Pacific tattoo art is thriving in Germany

US funding cuts threaten to 'dry up' future of Pacific scientists - expert

Vanuatu’s place on international financial blacklists is not just a political issue, it is making life harder for families, businesses, and workers across the country.

The Vanuatu Financial Services Commission (VFSC) says global pressure and tighter banking rules are slowing investment, making simple bank processes more complex, and limiting how easily money can move in and out of the country.

Vanuatu is one of only three Pacific nations, alongside Palau and American Sāmoa, still on the European Union’s blacklist of non-cooperative countries and territories for tax purposes.

Being on that list makes foreign banks more cautious about dealing with Vanuatu. That can mean more checks, higher costs and, in some cases, banks cutting ties altogether.

Branan Karae, the VFSC Commissioner, says the impact is being felt well beyond government offices.

“Businesses such as agriculture and tourism have thrived but the government initiative has been hindered by a lot of those global standards where it’s difficult for foreign banks to accommodate the needs there,” Karae tells PMN News.

Vanuatu Financial Services Commission is the financial regulatory authority of Vanuatu. Photo/Supplied

He says key sectors such as agriculture and tourism have performed strongly, but wider government efforts to grow the economy are being held back by global financial standards that make it difficult for foreign banks to support local needs.

Vanuatu is not alone. According to the World Bank, Pacific Island countries have experienced one of the sharpest declines in correspondent banking relationships in the world, dropping by about 60 per cent over the past decade.

These relationships allows a local bank to connect with larger international banks so money can be transferred between countries. Without them, sending remittances, paying overseas suppliers or receiving investment becomes more difficult and more expensive.

Watch the World Bank President's visit to Tuvalu below.

During a visit to the Pacific in 2024, Ajay Banga, the World Bank Group President, announced a project involving seven island nations including Vanuatu aimed at strengthening these key banking links.

"Safeguarding continuous access to international financial services is essential for the families and businesses of Pacific Island Countries," Banga said in a statement.

Vanuatu is now looking to a key moment in November - the Financial Action Task Force (FATF) Mutual Evaluation Review. The assessment will examine the nation’s laws and systems to prevent money laundering and terrorist financing.

Karae says passing that review could help rebuild confidence. “If we ultimately pass the FATF assessment, it will help to grow more businesses,” he said.

“When you grow more business, it means more business for employment for the locals, more opportunity for our kids, coming out from university to be able to be an opportunity to be employed, more income for the locals and all this. The add-on effect for the economy should be good.”

The IOSCO is the international body that brings together the world's securities regulators and is recognized as the global standard setter for financial markets regulation. Photo/Supplied

In a positive step, Vanuatu has recently become an Associate Member of the International Organisation of Securities Commissions, a global body that sets standards for financial market regulation.

Officials hope this signals progress in improving oversight and rebuilding trust. But for many in Vanuatu, the issue is simple: easier banking means easier business, steadier jobs and smoother money transfers for families.

As the Pacific continues to push for fairer treatment in global finance, Vanuatu’s upcoming review could prove a turning point for its economy and for the everyday people who depend on it.