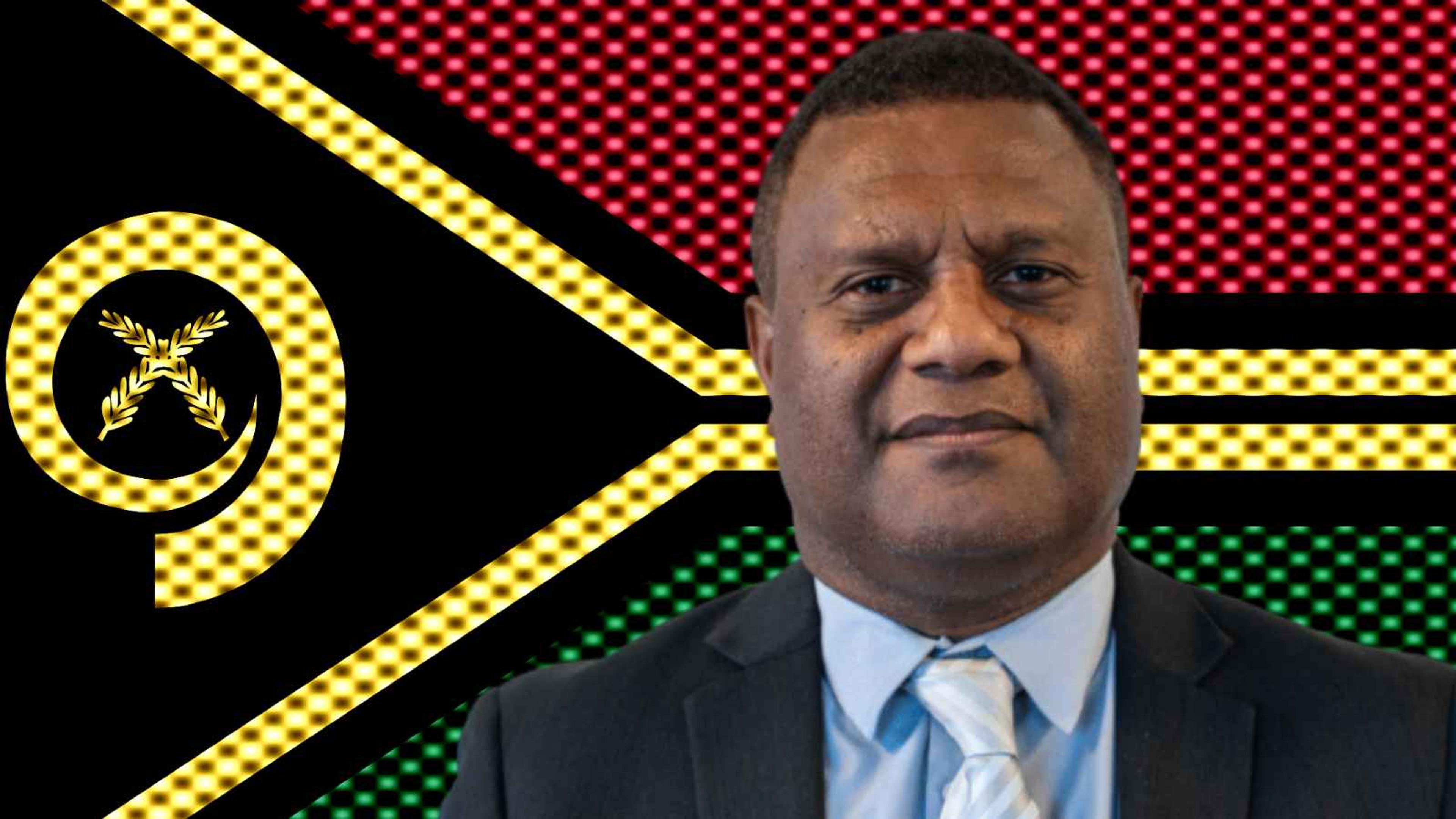

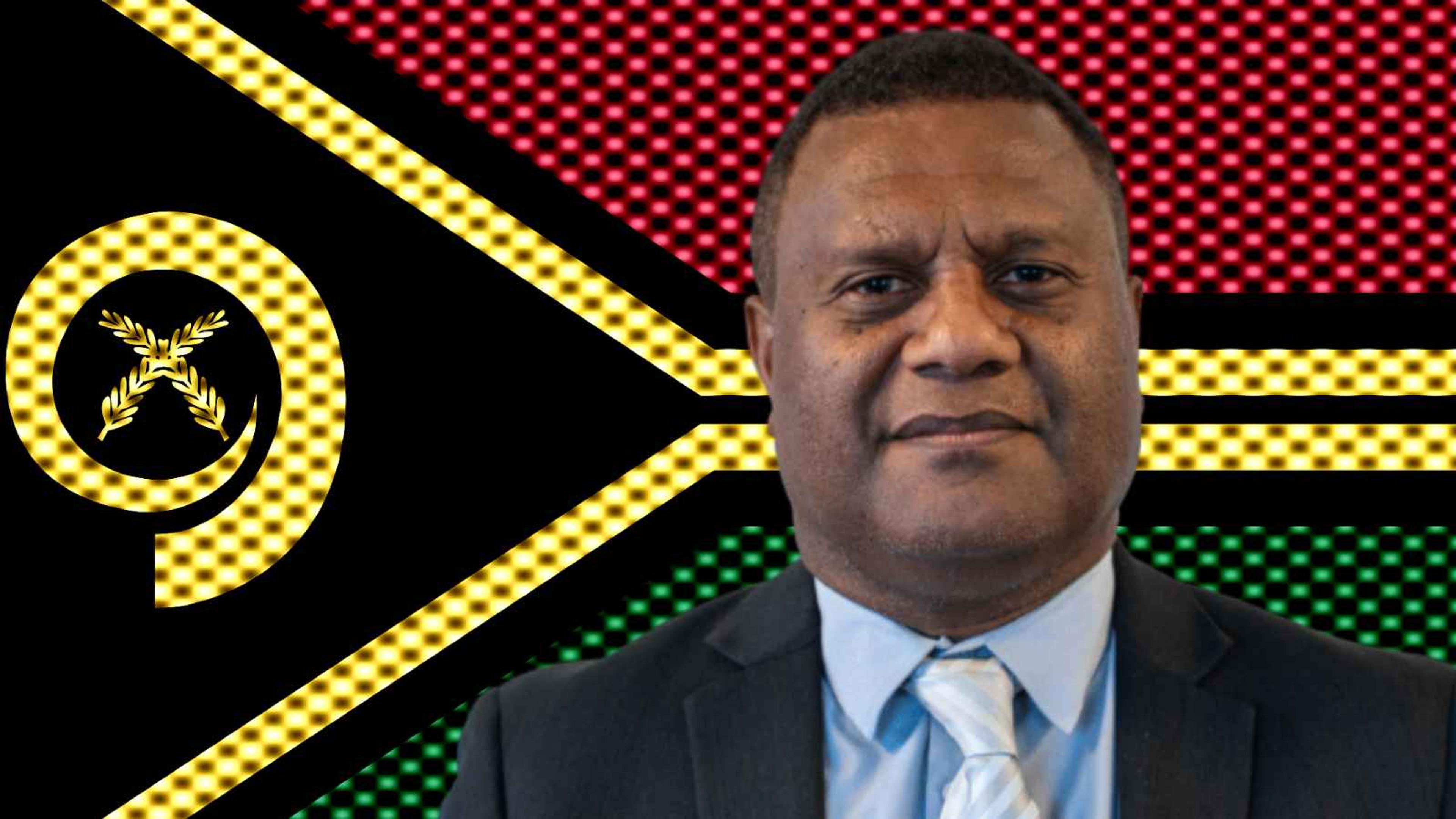

Joel Abraham is the chief executive officer of the Fijian Competition and Consumer Commission.

Photo/FCCC

Bankers come under scrutiny

Fiji's Competition and Consumer Commission has launched an investigation into the operations of several retail banks in the country.

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Pack your tissues: Free movies return with Tinā set for South Auckland

Manurewa charity requests $30,000 to keep Pacific seniors monthly gatherings

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Pack your tissues: Free movies return with Tinā set for South Auckland

Financial institutions found to have abused their social licence in Fiji will be dealt with accordingly, the country's competition and consumer commissioner warns.

Joel Abraham's comments follow allegations made by some customers of "price manipulation" by their banks.

He says the Fijian Competition and Consumer Commission has launched an investigation into the financial services sector.

Speaking to Fijivillage's Straight Talk host Vijay Narayan, about the cost of living and the recent Budget announcement in the country, Abraham said the commission received complaints from customers who claimed they lost their property due to bank foreclosure.

Abraham said a man claimed he secured a bank loan for $100,000 for a piece of land that the financial institution valued at $150,000. But the man later lost his job and was unable to repay the loan.

Abraham said the bank then foreclosed on the property, revaluing it at $85,000 while trying to resell the plot to a new buyer.

"How can the valuation drop when we all know land is an appreciating asset? This is a concern," he said.

"How many Fijians have lost their homes, have lost their properties, have lost their investments as a result of bank foreclosure?

"If the allegations by the complainants are true then there seems to be a high degree of collusion between the bankers, the lawyers, and some other people in the market to be able to - that when properties come out, there's already a buyer.

"From the complaints we've received, we are told that a buyer has already been arranged by the banks for these foreclosures. They go hard and they foreclose you or they'll continue to increase your variable interest until you can no longer pay then you get out of the market."

Abraham said the commission "condemned strongly this predatory practice", and would continue to speak with other Fijians who had lost their property due to bank foreclosures in the last five years.

He urged customers who felt they had been treated unfairly by their banks to contact the commission.

Kiwibank was launched as a New Zealand-owned counter to the Big Four Australian banks, but now faces criminal charges over some of its practices. Photo/RNZ

He said a report on the commission's findings would be released to the Office of the Financial Ombudsman.

Abraham warned if it is found that the banks have abused their licence, the rules will need to change.

The banking federation in Fiji was approached for comment.

In New Zealand, banks have been accused of "countenance overcharging" their customers by millions of dollars for more than 20 years.

The Commerce Commission's interim draft report into retail banking and the introduction of legislation into open banking was released in March.

But last week, the commission charged Kiwibank with 21 criminal charges under the Fair Trading Act for overcharging fees and interest rates on home loans, overdrafts, and credit cards.

The commission claimed the charges were "longstanding, systemic breaches" with Kiwibank's manual and electronic systems since 2002.

The experts said the commission's recommendations to use Kiwibank as a disruptor to the Big Four banks - ANZ, ASB, BNZ, and Westpac - by beefing up its capital, failed.

The Banking Reform Coalition said there was a "real structural problem with bank profitability" in Aotearoa.

In the Pacific, the region is facing a debanking crisis, a banking forum in Brisbane was told last week.

The withdrawal of major banks from the island states poses significant socio-economic risks to the region, the Pacific Banking Forum heard.

This has prompted the governments of New Zealand, Australia, and the United States to intervene.

Debanking is when the banks close or restrict their customers' accounts because they believe these individuals pose regulatory, legal, financial, or reputational risks to the bank's operations.

The Pacific Banking Forum was established last year by Australia and the US to look into concerns about the loss of correspondent banking relationships in the region.

Policymakers, regulators, commercial bankers, technical experts, and other stakeholders attended the forum to support the Pacific Island Forum Secretariat’s correspondent banking initiatives. Forum secretary-general Baron Waqa was also there.

The forum also found that while the big banks were happy to follow the money while ignoring their responsibilities, so too were the banking minnows.

Participants agreed that the only thing at risk here was people’s faith in the banking system.

The Pacific Business Forum in Brisbane last week was organised by the Australian government and the US State Department. Photo/supplied