Tāmaki Regeneration is spearheading a co-ownership initiative committed to making homeownership a possibility for more people.

Photo/AWHI

Co-ownership model paves unique path to homeownership for Pacific, Māori families

With only 16.8 per cent of Pacific people owning homes in Aotearoa, community-led actions are breaking down financial barriers for aspiring Māori and Pasifika homeowners.

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Pack your tissues: Free movies return with Tinā set for South Auckland

Manurewa charity requests $30,000 to keep Pacific seniors monthly gatherings

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Pack your tissues: Free movies return with Tinā set for South Auckland

As Pacific homeownership rates fall behind the national average, various organisations are spearheading initiatives aimed at helping families secure ownership.

New census data released by Stats NZ shows that Pacific homeownership has dropped significantly, with only 16.8 per cent of Pacific people owning homes in 2023, compared to 42.1 per cent of all New Zealanders.

To address the barriers to homeownership, initiatives across the country are emerging, reimagining the traditional model of homeownership.

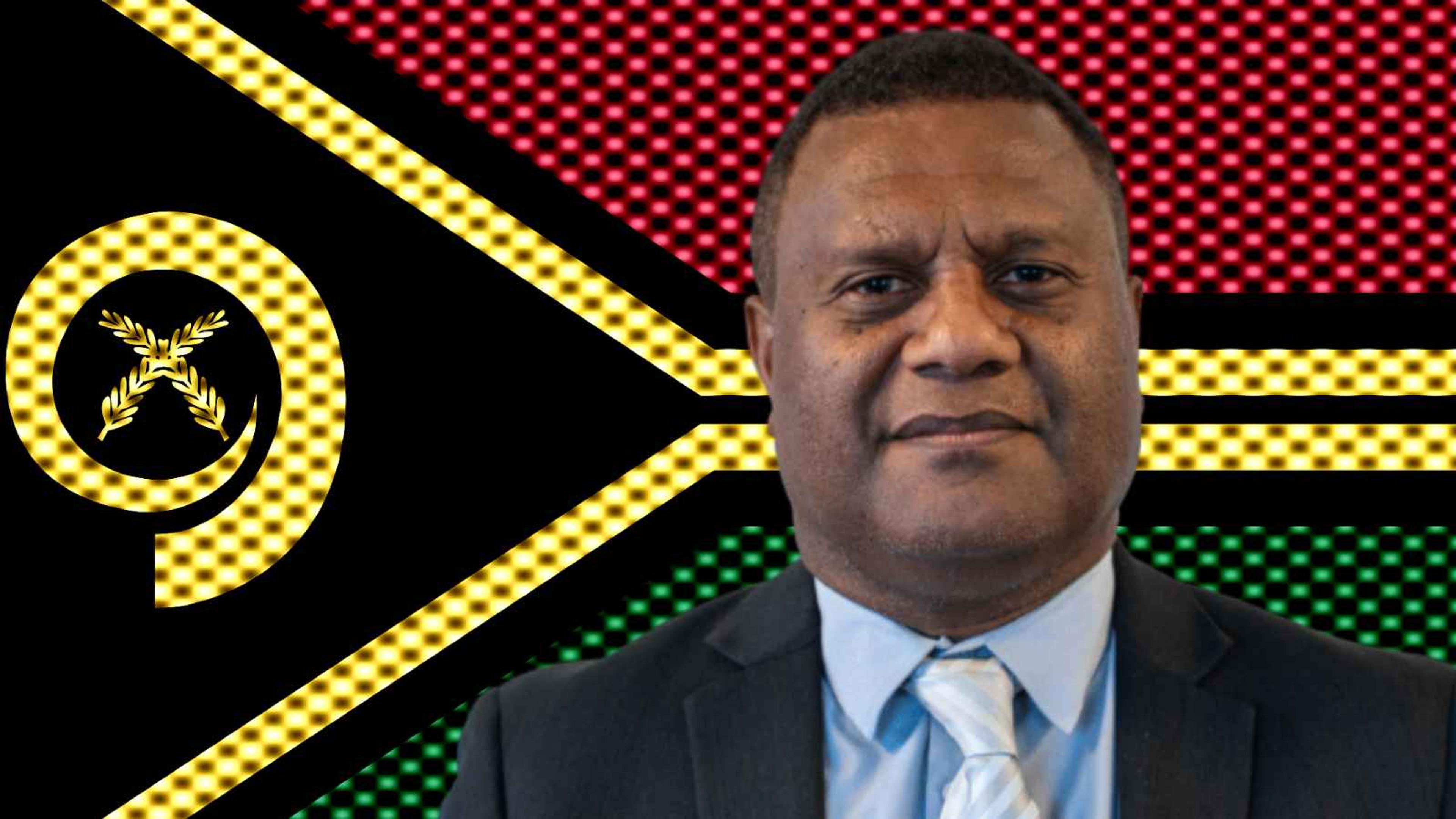

Afoa Tevita Malolo, the General Manager of Social Transformation and Partnerships at Tāmaki Regeneration, spoke to PMN News about their ‘OWN IT’ shared homeownership initiative.

Malolo says financial literacy, debt accumulation, and lower income levels continue to pose significant challenges for Pasifika families in New Zealand.

“The standard or the normal barriers for whānau are debt and income,” he says. “A lot of our families just don't have the household income to meet some of the requirements from banks, and our families have just not been exposed to financial literacy concepts around budgeting and saving for a rainy day.”.

Afoa Tevita Malolo says the OWN IT programme is based on a track record of delivery for the people of Tāmaki. Photo/supplied

Tāmaki Regeneration is a government-backed housing initiative operating in the East Auckland suburbs of Glen Innes, Panmure, and Point England, including some of the most expensive suburbs in the country.

The ‘OWN IT’ initiative was developed to provide pathways to homeownership for those at risk of being displaced from Tāmaki due to rising rental and property prices.

Nearly 1500 homes are being built in Tāmaki for the ‘OWN IT’ scheme, with over 100 families already receiving support for homeownership through the programme.

Co-ownership reduces the deposit amount required since Tāmaki Regeneration retains up to a 30 per cent stake in the home, allowing buyers to secure the remaining 70 per cent of the total purchase price.

Home buyers have up to 20 years to buy out Tāmaki Regeneration’s equity in their property. ‘OWN IT’ is one of New Zealand’s few large-scale co-ownership initiatives and one of the largest in the Auckland region, mainly benefiting families in East Auckland.

While the programme is not exclusively for Māori and Pacific families, nearly 80 per cent of ‘OWN IT’ buyers are from these communities.

‘OWN IT’ also encourages intergenerational families to participate in homeownership together, increasing eligibility for individuals who might not qualify on their own.

Intergenerational families must have a combined income between $85,000 and $205,000 to qualify for ‘OWN IT’.

Malolo says banks are increasingly recognising co-ownership as a valid path to ownership, meaning families do not face inherent disadvantages when applying for a mortgage through a co-ownership agreement.

Tāmaki Regeneration is building nearly 1500 homes across the Tāmaki suburbs of Glen Innes, Point England, and Panmure. Photo/supplied

“The banks are really supportive of this model. I think the key thing for banks is that there's a lower threshold in terms of the mortgage. The deposit requirements don't need to meet the 20 per cent threshold [like] in a standard purchase,” he says.

ASB, Westpac, and SBS are among the partners of Tāmaki Regeneration that recognise the co-ownership model.

Tāmaki Regeneration also provides financial literacy tools and one-on-one guidance through ‘OWN IT’ to prepare families for the financial responsibilities of homeownership.

Malolo says Tāmaki Regeneration is building a pipeline of families interested in joining the programme and is committed to maintaining support from central and local government partners.

“We're building houses at scale and at pace as well. We've also been able to deliver on outcomes for our community,” he says.

“The ability to free up another state house for another family reduces that government liability. So if we can continue to show outcomes for Māori and Pasifika, you get them into home ownership, everything changes [for them].”

Photo/supplied