The Asian Development Bank projects slower economic growth for the Pacific region.

Photo/Tourism Fiji

ADB: Slower economic growth for Pacific amid tourism challenges, global uncertainties

The Asian Development Bank emphasises the need for public investment and improved private sector development to enhance resilience against external shocks amid rising inflation and trade tensions.

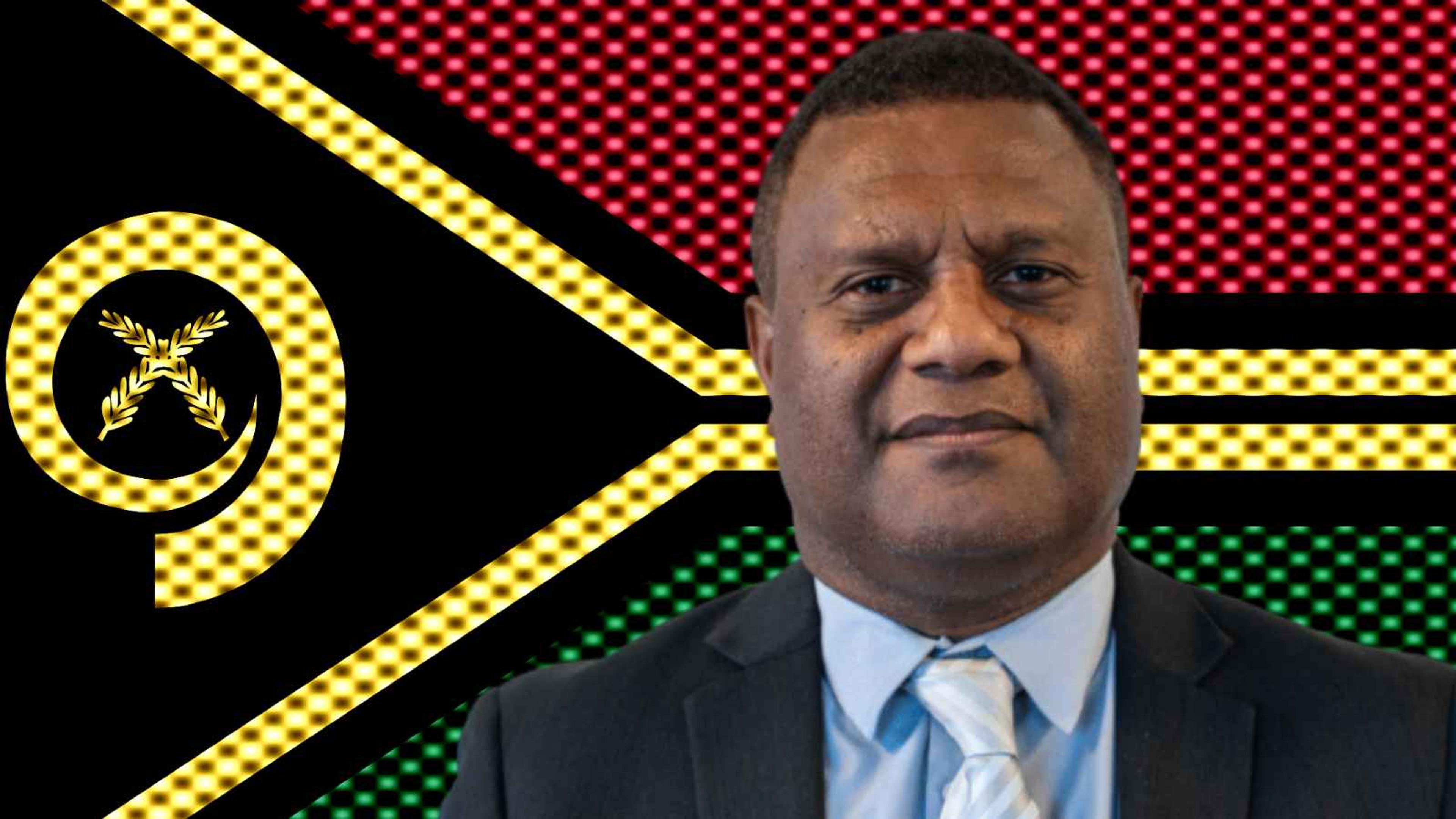

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Pack your tissues: Free movies return with Tinā set for South Auckland

Manurewa charity requests $30,000 to keep Pacific seniors monthly gatherings

Blacklisting squeeze hits Vanuatu families and businesses, the regulator VFSC warns

Pack your tissues: Free movies return with Tinā set for South Auckland

The Asian Development Bank (ADB) predicts that tourism growth in the Pacific will be slower over the next year, which may lead to a dip in the overall economic growth to an average of 3.9 per cent in 2025 and 3.6 per cent in 2026.

In its Development Outlook released earlier this month, the ADB projects regional growth to be lower than the regional average.

Emma Veve, the ADB's Director-General for the Pacific, says the report reflects "expected easing" in tourism, a key growth driver in many economies in the subregion, and "muted" petroleum production in Papua New Guinea, the subregion's largest economy.

Despite some growth in recent years, Veve emphasised that the Pacific is still vulnerable to unexpected changes in the global market. She says the ADB is dedicated to building resilience in these economies and ensuring fair and sustainable growth.

Veve says the bank remains committed to helping build resilience, further improving public service delivery, and promoting inclusive and sustainable growth in the subregion.

Fiji, the Pacific's second-largest economy, has grown strongly due to increased visitors and consumer spending. But the ADB forecasts that Fiji's growth will be around 3.0 per cent in 2025 and 3.2 per cent in 2026, which is lower than the region's average.

The report also stresses the importance of government investments in improving tourism infrastructure and the need for a supportive environment for businesses to thrive.

According to Fiji's Bureau of Statistics, 63,842 tourists visited the country in March, compared to 49,483 arrivals in February. Of the 63,842 visitors, 62,638 came by air while the others arrived by sea.

While the ADB's forecast was made before President Donald Trump announced recent tariffs, the report includes insights on how such trade policies from the US could create uncertainty that slows down trade and investment.

Emma Veve says the ADB remains committed to helping build resilience, further improving public service delivery, and promoting inclusive and sustainable growth in the subregion. Photo/ADB

The report also states that inflation, the rate at which prices rise, could increase to 3.4 per cent in 2025 and 2026.

The ADB has committed US$24.3 billion (NZ$40.7b) in 2024 to help tackle various development challenges in the Pacific and Asia.

This funding will be complemented by an additional US$14.9b (NZ$25b) from partners, making over US$39b (NZ$65.36b) available for important projects.

In its Annual Report 2024, the ADB highlighted how it assists developing countries in progressing towards sustainable, inclusive, and resilient growth.

“We are financing more affordable and efficient energy and transport

systems, supporting a vibrant private sector that creates better-quality jobs, and strengthening basic services in education, health, and social protection," Masato Kanda, ADB's President, says in a statement.

The US$24.3b includes various forms of support like loans, grants, investments, guarantees, and technical assistance for governments and private companies.

US President Donald Trump. Photo/The White House

Meanwhile, the International Monetary Fund (IMF) is concerned about rising government debt around the world.

It warns that Trump's tariff policies could raise government debt to levels not seen since World War II.

Vítor Gaspar, who leads the IMF’s fiscal affairs department, told the Financial Times that under their worst-case scenario, public debt could rise from 92.3 per cent of the world's overall economic output to 117 per cent by 2027 - and this estimate might even be too optimistic if trade tensions worsen.

He says that in 2025, growing uncertainties, increased trade tensions, tighter financing conditions, and more volatility in financial markets caused financial strain.

Gaspar's warnings come as the IMF released forecasts indicating that 75 per cent of the countries contributing to the global economy, including the US, China, Germany, France, Italy, and the UK, may face higher debt levels in 2025 than the previous year.

Watch economist Hillmare Schulze's reaction to the World Bank's Pacific Economic Update.